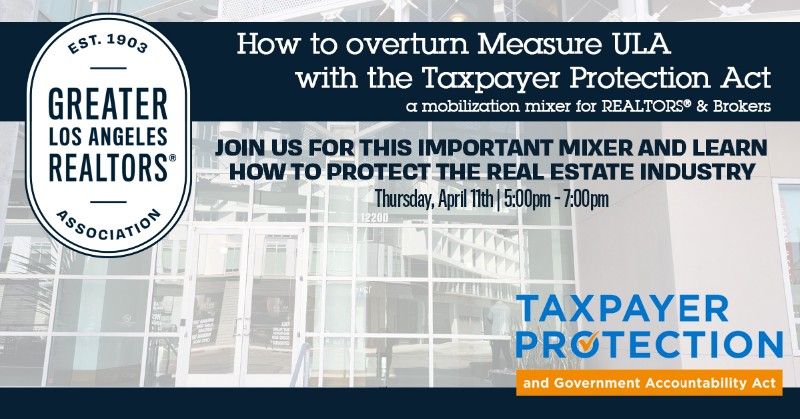

Join GLAR's for this important mixer and learn about how the Taxpayer Protection Act is fighting Measure ULA and how you can help!

This event is free to GLAR Members, space is limited so please register today!

Limited Space - Register Today!

In November 2022, Los Angeles voters approved Measure ULA, which city leaders and special interests sold as an equitable "tax-the-rich" scheme targeting property sales of over $5 million to resolve the city's housing and homelessness crises.

However, the clear reality since Measure ULA went into effect back in April 2023 is that Measure ULA’s heavy taxation is killing the housing sector and is barely generating any money to combat the City’s homeless crisis.

Measure ULA has not only generated a fraction of what was originally promised, but is also having a chilling effect on LA’s real estate market. Home sales have plummeted by more than 25 percent as many property owners do not want to sell due to Measure ULA’s 4 percent tax on home sales of more than $5 million, and its 5.5 percent tax on those above $10 million. That means property owners and homeowners subject to Measure ULA are responsible for paying at least $200,000 or more when they sell. As a result, many homes are now being leased instead.

Fortunately, there is a solution: the Taxpayer Protection and Government Accountability Act (TPA) — a proposed statewide ballot measure that would create new protections in the California constitution for all taxpayers in one of the nation’s highest-taxed states. Voters will get a chance to decide the fate of TPA during this November’s election.

LA’s Measure ULA is a prime example of the need for the TPA. The special interests behind Measure ULA utilized a loophole created by the courts to bypass Proposition 13’s requirement that all dedicated taxes pass by a two-thirds vote. As a result - as we predicted in our organized opposition to the measure - the local real estate market is paying the price.